The Icing That Isn’t So Sweet

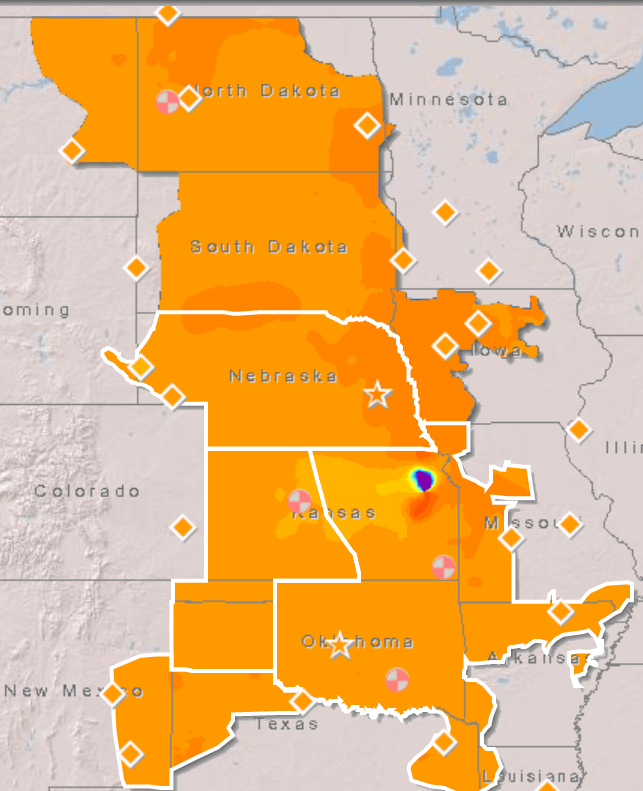

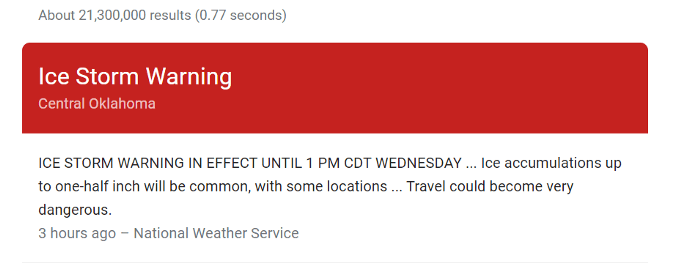

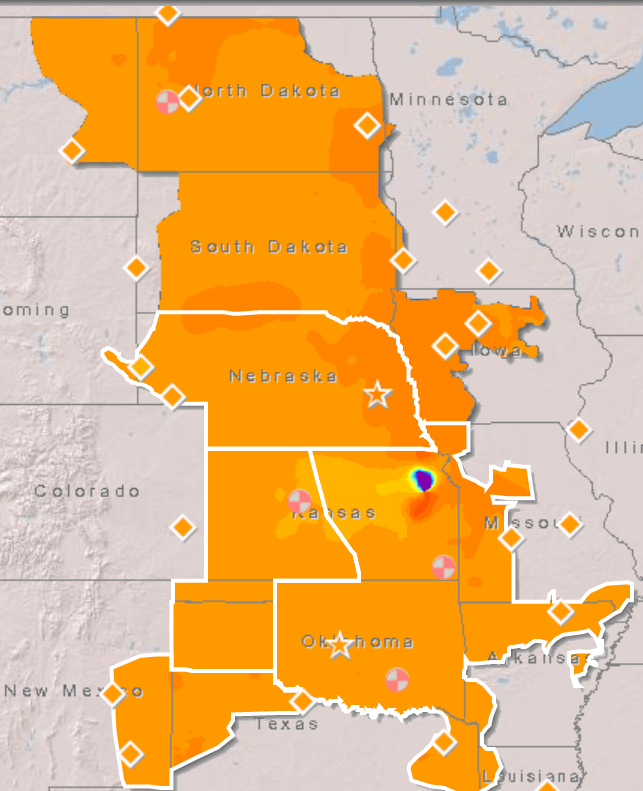

October 26th was a record-breaking day for wind generation in many of the US ISOs — not for magnitude of production or output, but for magnitude of forecast miss! A massive cold front was sweeping south from the Plains with freezing precipitation and strong sustained wind gusts along its leading edge. While these wind speeds would normally lead to strong resource output from windfarms, Monday morning proved to be a significant anomaly. Freezing precipitation coated the blades of windfarms in Kansas, Oklahoma, and Texas, preventing operators from safely running their units, and therefore depressing farm output to 0% at many sites within these states.

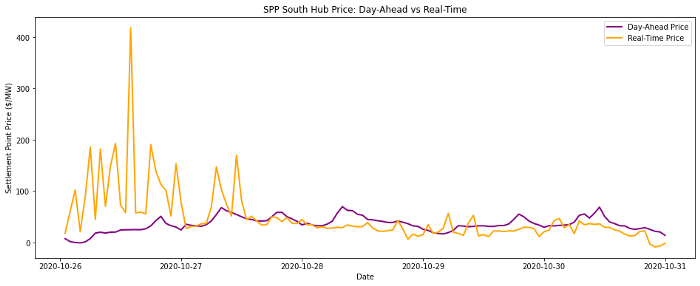

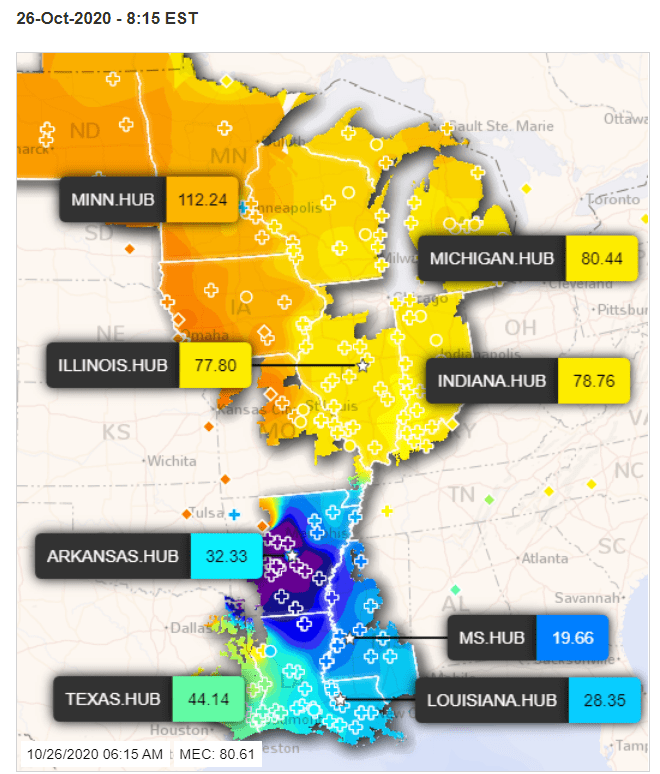

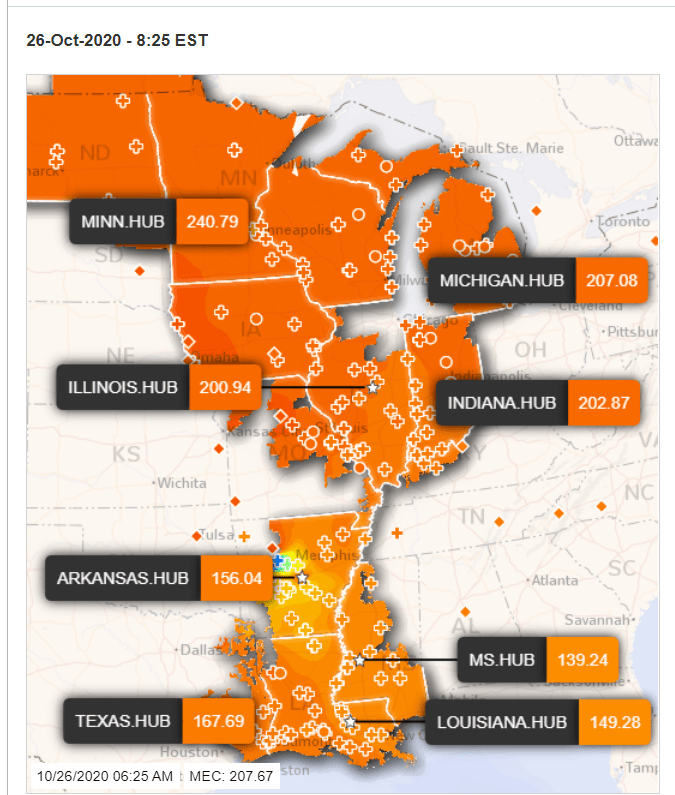

Icing effects were first felt in SPP territory. Prices spiked into the $200–800 range as demand ramped during the frigid Monday morning hours without the expected supply contribution from wind units in the southern half of the footprint.

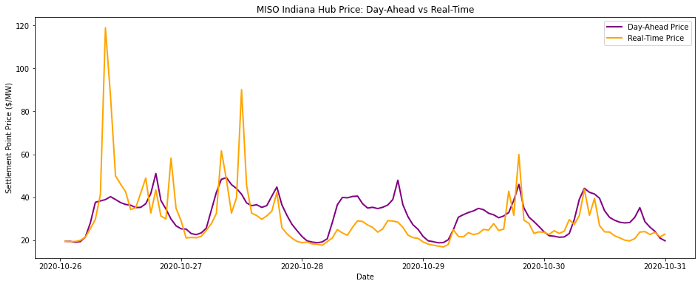

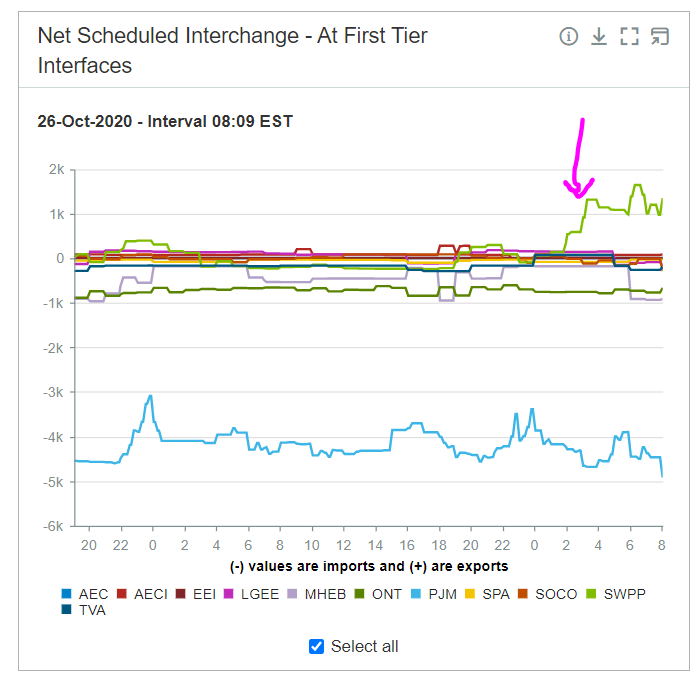

Such sustained pricing strength in SPP drew the attention of real-time and physical traders, who sought to capture this pricing strength by exporting power from MISO (the neighboring ISO to the east) into this region. Imports from MISO to SPP surged by 1–1.5 GW from 3am-9am.

Strong transmission congestion between MISO South and SPP then appeared as flows rushed from Arkansas into Oklahoma to outweigh the load vs generation imbalance.

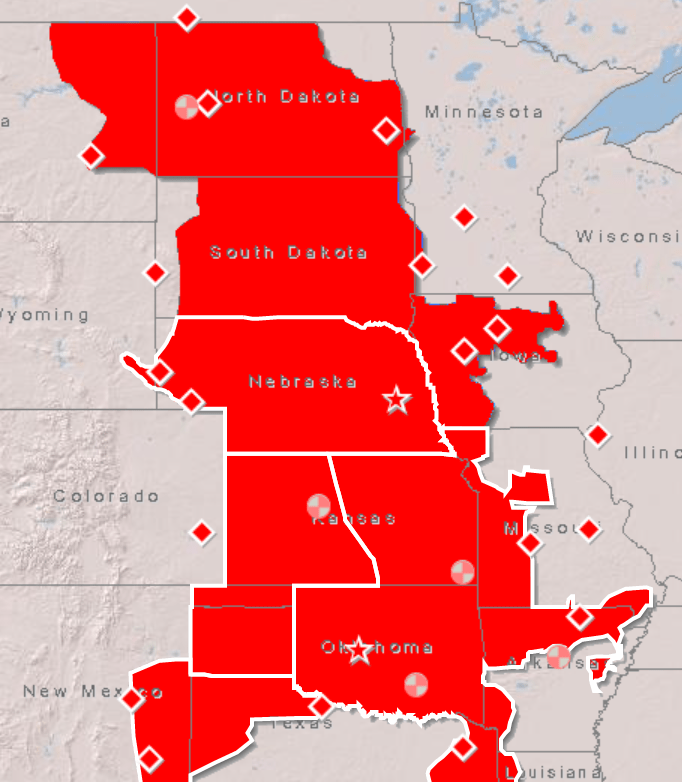

While windfarms in MISO were mostly spared from the ice storm, telemetered demand grew significantly stronger than forecast by 8am, and the unexpected export of power to neighboring SPP then drove MISO energy prices well above day-ahead levels as well. MISO energy prices eventually settled down when demand returned to levels closer to forecast, but SPP continued to require >$100 prices to ensure sufficient thermal generation.

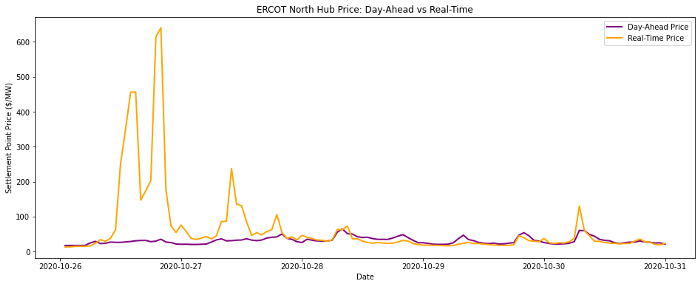

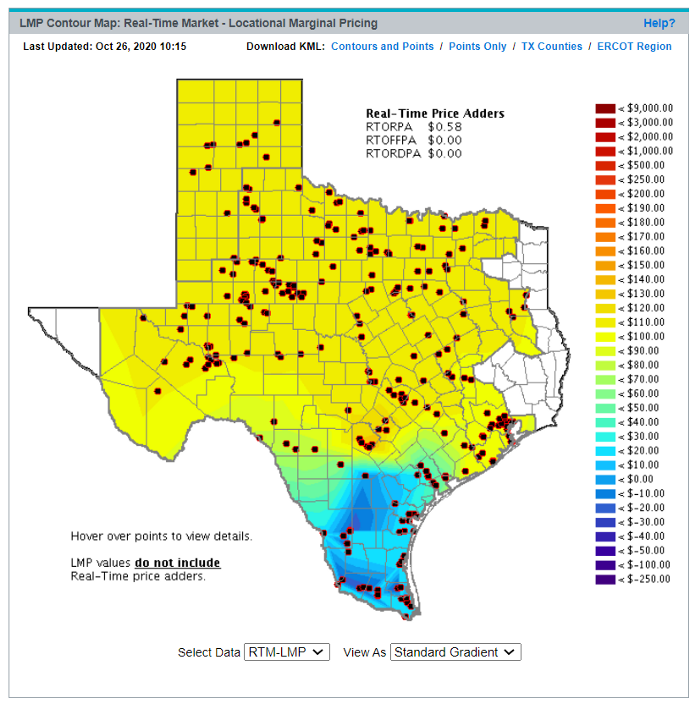

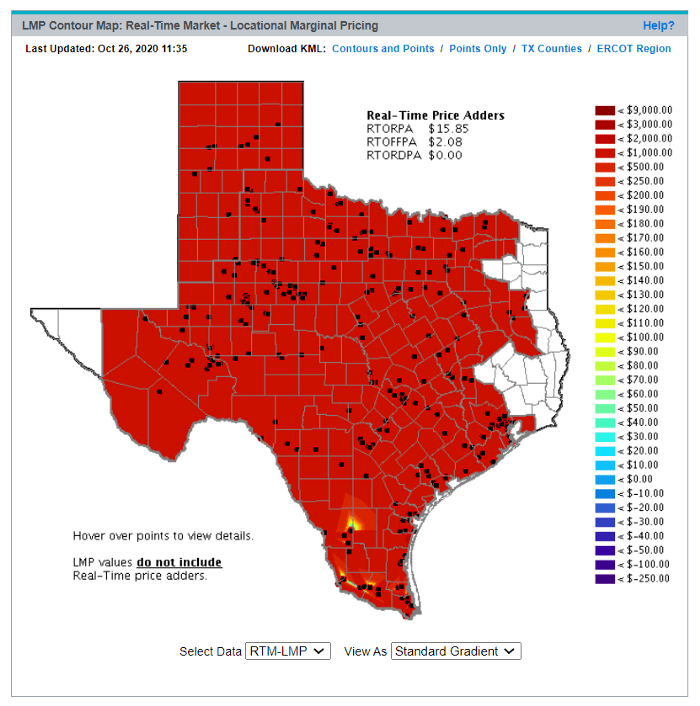

Within two hours, the front had pressed further south into Texas, and impacts were immediately felt in the ERCOT market. “Backwards” South → North congestion quickly ensued as wind output in the northern half of the state fell offline while southern and coastal farms generated with unperturbed strength.

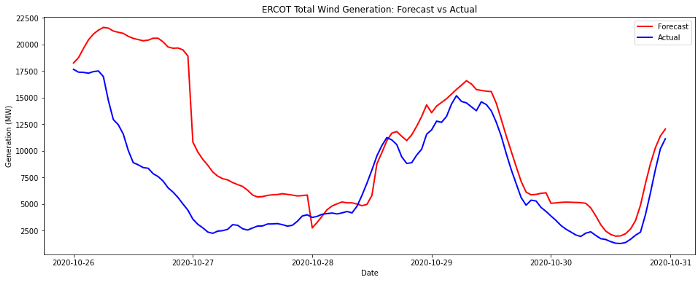

As the freezing precipitation extended deeper into the footprint, the magnitude of wind forecast miss continued to grow and cancel out any expected surge in production from the heavy wind speeds. Wind forecasts missed by as much as 15GW, driving unbridled energy price strength for hours through the afternoon. HB_NORTH saw it’s highest on-peak average price in all of 2020, exceeding even the strongest days in peak summer months.

Unfortunately for windfarm operators, the duration of cold temperatures and out-of-service transmission lines kept the nightmare alive beyond Monday. While prices were lower on Tuesday, volatility remained high from overvalued day-ahead wind forecasts.

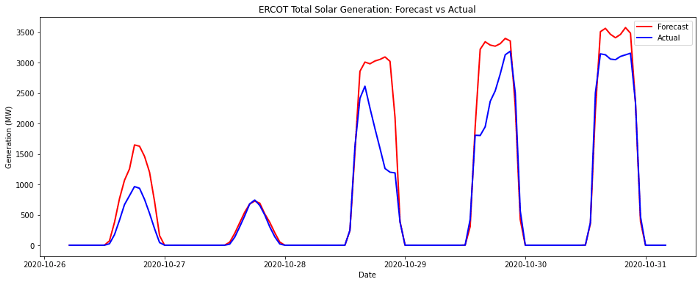

Solar generators also saw impact from ice and snow coating their farms, but the resulting MW miss was far less significant than that from wind generators given the relative installed capacity of each resource type in Texas.

Plots of real-time prices vs ISO day-ahead forecasts in the final week of October reveal stark widespread volatility.