The ERCOT Week that Was

It used to be that climate change was a more abstract concept with second or third order effects. This week we saw that it can have first order impacts.

MATT WYTOCK, CEO, GRIDMATIC

How bad was it?

- ERCOT came within 900MW of total failure and full system collapse.

- The market produced day-ahead solutions with >$8500 pricing — the highest on-peak DAM ever. Usually in the Summer it’s just 3–4 hours of pricing in the low thousands for the absolute peak days.

Why was it so bad?

- The predominant problem was not a nodal problem, but rather forecasting and balancing load and supply.

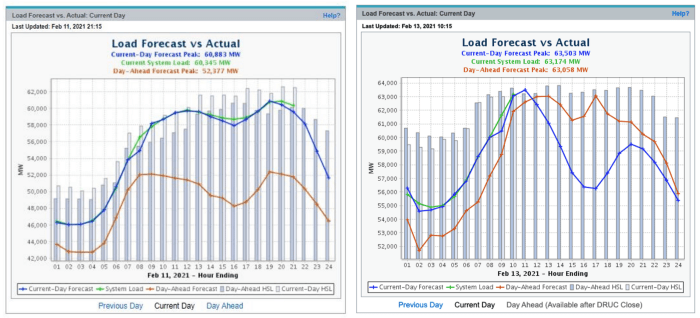

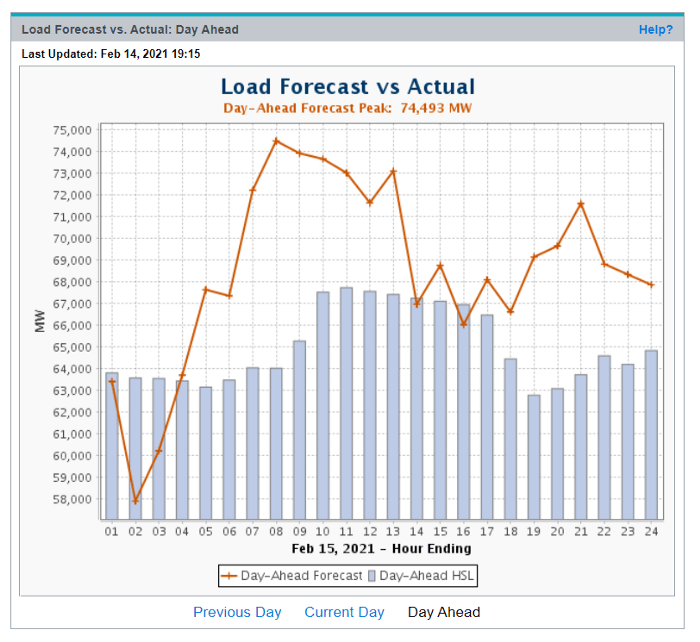

- Load: Without strong comparison days for this deep of a freeze — especially at the same population and present industrial levels — and with low temperature records being set at many major cities, ISO load forecasts were off in both shape and magnitude. Example ERCOT load forecasts:

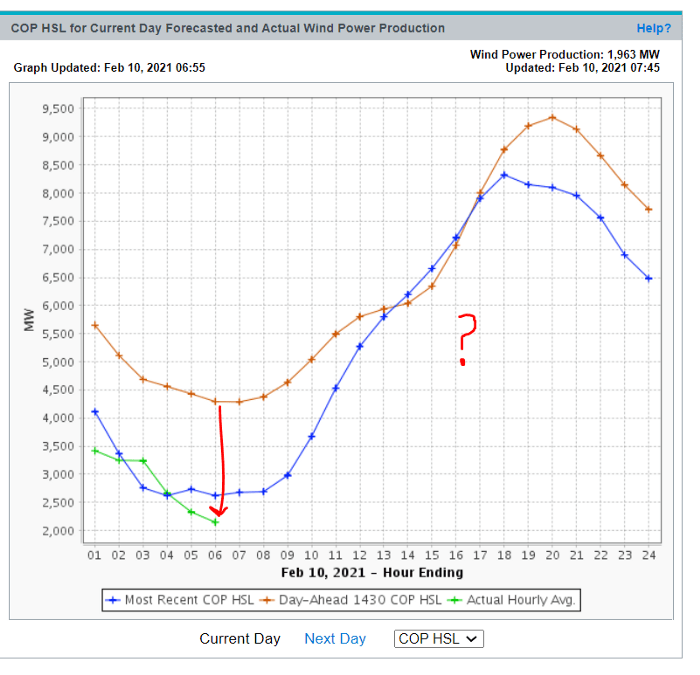

- Wind: A large front ushered in the polar air, dumping ice along its leading edge and snow behind it. Windfarms in ERCOT’s densest wind production zones (Panhandle and West) were frozen first as early as Wednesday 2/10. The front slowly worked down in the South and Coast by Sunday 2/14, before the more northern farms could thaw. A whopping 22.5 GW of renewable generators were out of service by Monday 2/15. These farms were not able to produce any power, no matter the gusts along the Coast or in the West.

- Solar: Clouds accompanied this precipitation, thereby limiting solar output to trivial amounts of MWs among those that weren’t also subject to the same frozen (and then snow-blanketed) fate as the windfarms.

- Thermal: Cold temperatures caused thermal generator ramping issues and access to fuel … not to mention attempting to acquire gas fuel at 10–100x the normal price

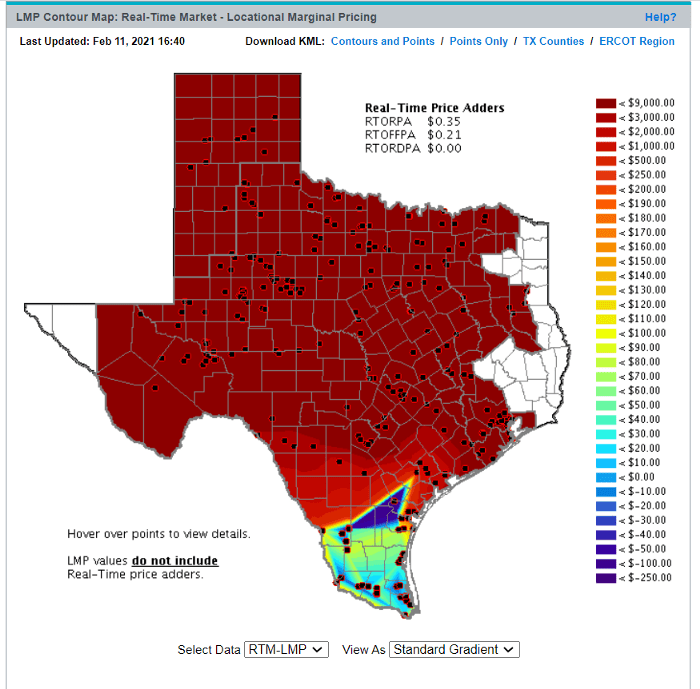

- Transmission: High-voltage transmission toppled or was forced out of service with the icy winds, resulting in a shifting nodal congestion nightmare:

The ultimate issue? There was too much demand (forecast in red) for the amount of available supply (in grey bars) many hours of the day:

What are fallout and knock-on effects?

- Small retail will see the most financial trouble to start, particularly those that take wholesale exposure themselves.

- This doesn’t even take into account make-good payments that may outweigh costs.

- Knock-on effects included insufficient Ancillary Services due to providers shifting to the $9k RTM price (yet we then saw a $21k/MW hourly price for RRS).

What does Gridmatic think the future holds?

- Forecasting: Obviously we need improved forecasting to balance supply and demand.

- Storage: Always considered the holy grail, but:

- Capacity would need to exceed PV dropout (or more, if there is GWs of simultaneous wind drop), and even that would require perfect dispatch.

- Storage cannot charge during EEA events because it is load. Storage is great for ramp up/down of emergencies but not for sustained imbalances.

- For this event, storage’s contribution was frequency response and helping hold the line in terms of preventing a tidal wave of outages.

- Capacity: Implementing a capacity market in Texas would take at least 5 years.

- Thermal & Gas: Priorities will go to existing markets and job creation; more funding will go to thermal gen and to winterize gas plants.

- De-icing: Wind farms or their guarantors could’ve been financially destroyed this week. Hedges: The “p50 hedge” will likely be entirely restructured; forward forecasts will get even more scrutiny.

- Markets:

- The market continued to function, albeit at maximum price, during the energy event.

- Such sustained high prices in DAM, RTM and A/S are likely to draw even more investor attention on the supply side.

- It is unlikely that market rules are revised, however the price cap could change.

- Price Cap can be administratively adjusted if the “Peaker-net-Margin” (basically the amount of profit earned by a proxy peaker plant) exceeds a certain level or is drastically lower than a certain level

How did Gridmatic do?

This was a stress test for the grid as well as for Gridmatic’s models:

- Our models were not prepared for sustained $9000 prices so we decided to sit out the first part of the week, which we had the option to do.

- Ultimately, we expect to see net positive financial results from the volatility once the dust settles.