Texas Hums in the Heat, While California Faces Blackouts

Much has been written about California’s forced blackouts in the Summer of 2020, but many may not realize that the Texas grid faced a near-crisis at the same moment. In this article, we compare a few key factors: resource mix, forecasts of load and renewables versus actuals, and market prices to show how drastically the results differed in the two states. Despite similar weather conditions on August 14, 2020, California faced blackouts while Texas energy was uninterrupted.

Comparing California and Texas Power Markets

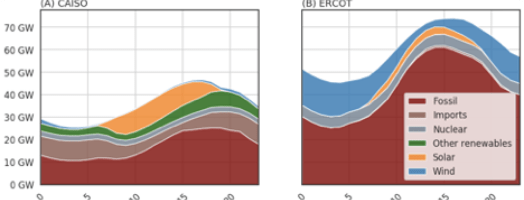

For context, both power markets serve similar population sizes (just above 30M and 26M, respectively) and have similar wholesale rates for energy. Both lead the nation in renewable capacity, with solar proliferating in CAISO and wind dominant in ERCOT. The major difference is in their peak load profiles with CAISO at 50.27 GW in 2006, and ERCOT at 74.8GW in 2019.

Though their grid conditions are comparable, the philosophies behind the markets differ substantially. California endeavours to protect consumers from wholesale market prices, while also trying to capture market efficiencies. CAISO operates several forward and real-time markets, but regulators such as the California PUC control retail prices and resource adequacy programs.

Texas adopts a fully market-based approach. ERCOT’s “energy only” market, which does not have a capacity obligation, relies on the $9,000/MWh price cap to temper demand and motivate project developers to enter the market. Price responsiveness of both resources and load is endemic to Texas.

A Market-Based Approach to Energy Pricing

A good example of Texas Market-Based Approach to pricing is its Four Coincident Peak calculation which bases the transmission and distribution portion of retail electricity bills on each customer’s consumption during the annual system peak demand hours. This is designed to give consumers a direct incentive to reduce load during peaks. And since no one knows in advance when that peak will be, consumers reduce load whenever grid conditions look tight.

Summer 2020 Peak

We compare August 14th, 2020 which was a hot day everywhere west of the Mississippi. If operators at CAISO and ERCOT had stepped outside their grid control rooms, they would have felt the furnace. They wouldn’t have been surprised, however. Peak temperatures were within 1°F of forecasts of 104°F and 105°F in Folsom, CA and Austin, TX, respectively.

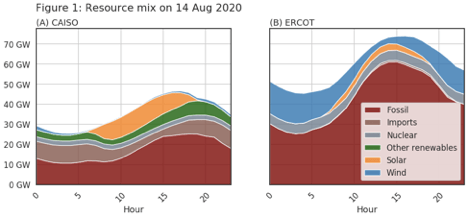

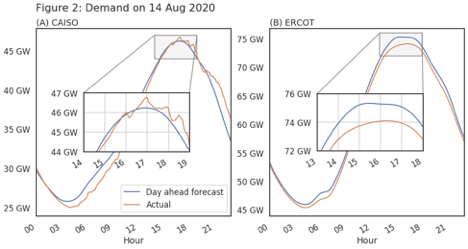

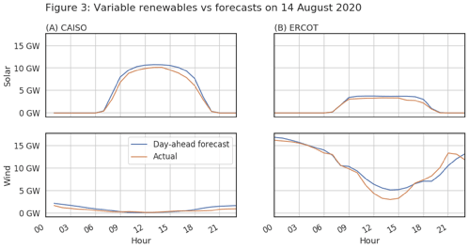

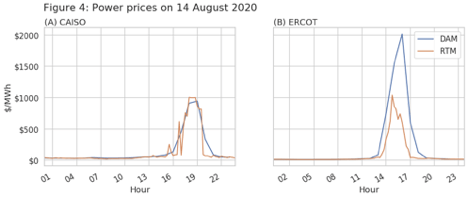

By 4 p.m., ERCOT was fast approaching its all-time peak load. CAISO saw high demand as well, but was several gigawatts short of breaking any records. These high loads were also no surprise. Day-ahead CAISO and ERCOT load forecasts were fairly accurate (see hours 0 to 15 on Figure 2). Market participants were well-aware of the tight conditions, with the Day-Ahead price (DAM price) clearing above $2,000/MWh at the peak in ERCOT and near the $1,000/MWh price cap in CAISO. During peak demand, CAISO’s load overshot the day ahead forecast by a few hundred MW, while in ERCOT, 1,500 MW of load voluntarily evaporated for three hours. ERCOT also received a gift from nature: summer wind in Texas regularly ramps up in the evenings, helping them match increasing evening demand.

Then the sun set on CAISO, shutting down the state’s solar resources. Figure 3 shows that neither wind nor solar day-ahead forecasts were far off. As load continued to rise to the evening peak, solar resources ramped down at an average of 40MW/min, and CAISO was unable to fill the gap with demand response or in-state generation, culminating in load shedding. Imports did ramp up, but not enough. Neighboring states were also blazing hot and needed to use their electricity supply locally. CAISO had hinted at the challenges of a region-wide heat wave in their 2020 Summer Loads and Resources Assessment, acknowledging “a declining nature of net imports as demand increases.”

As load in California began to peak, CAISO grid operators initiated rolling blackouts around 5pm, and expanding them around 6pm. It is extremely difficult to estimate the value of that lost load, but it’s clear that California’s blackouts cost far more than keeping the lights on, even at $1,000/MWh.

In Texas, ERCOT customers responded to the peak price signals and were able to prevent both a Real-Time price (RTM price) spike and a blackout. ERCOT RTM prices came in around $1,000/MWh at the peak, roughly 50% of the DAM price. Studying these final prices, however, obscures how close the Texan power grid came to the brink of disaster. The ERCOT control room issued a capacity advisory as responsive supply dwindled below 3,000MW. ERCOT was within 700MW from an energy emergency declaration (EEA1), which would automatically set all energy prices in ERCOT to $9,000/MW. This clear threat of maximum LMPs motivated sufficient response from load and generation to keep the system away from emergency operations.

Blackout Impact on Pricing

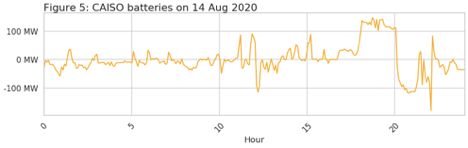

Perhaps the most fascinating element of August 14th, is that the blackouts actually lowered CAISO’s prices. By unplugging customers, CAISO effectively reduced demand, and RTM prices plummeted. This price signal triggered the state’s emerging energy storage resources to start charging up in response to the published prices while the system was still in an emergency shortage. Gigawatts of batteries are set to come online in 2021 — enough to significantly help or hurt, depending on how they are used.

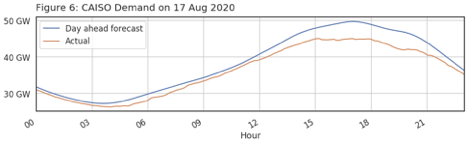

While CAISO demand exceeded forecast on August 14th, just three days later, California’s customers showed that they are able to voluntarily conserve power as effectively as their counterparts in Texas. On August 17th, while the CAISO system continued to peak, a combination of demand response, diesel backup generators, CAISO emergency actions, and tweets from the governor, shaved nearly 5 GW off the predicted peak.

On August 14, 2020, CAISO and ERCOT faced similar conditions, but created different outcomes. ERCOT had the gift of an increasing wind resource during peak demand, while CAISO had a decreasing solar resource. But beyond differences in their resource profiles, ERCOT appears to have successfully used price responsiveness to manage reliability, while CAISO could not. ERCOT’s $2,000/MWh DAM prices and the threat of very high RTM prices incentivized voluntary demand decreases. The vast majority of available in-state thermal generation was already running, hoping to catch a price spike. Unfortunately, CAISO’s price hit its cap at $1,000/MWh. Without a price spike to incentivize generators or imports, and state protections preventing a price signal to demand, CAISO was forced to shed load. And RTM prices came down with the lights.

Conclusion

As written about in recent articles, California — with its expensive real estate, strict business regulations, and wildfires with their resulting air quality issues — has been losing residents and corporations to other states. Ironically, Texas is the most popular relocation destination. Blackouts are a major impediment to business and can only add to the concerns of residents and businesses considering relocating.

As an indication of how severe this situation is, CAISO recently announced that it has embarked on “a deep dive into the causes of the outages and the joint development of actions to be taken to prevent supply gaps in advance of summer 2021” along with a Summer Readiness web page that to provide easy access to data and reports related to these causes and lessons learned from the 2020 outages.