Control uncertainty via the power of AI

Gridmatic applies AI to the increasing complexity and volatility of energy markets to ensure optimal results for storage systems while supporting grid needs. We take on the challenge of forecasting prices and accurately timing market participation with strategies tailored to owners’ specific risk-reward objectives. We operate battery systems in ERCOT and CAISO and offer the following:

BID OPTIMIZATION AS A SERVICE

Battery system owners receive bid optimization delivered on an automated algorithmic basis using our proprietary market price forecasts.

REVENUE FLOOR PLUS SHARING

Project owners are guaranteed revenue plus a share in the market upside with commitments for the revenue floor backed by Gridmatic’s $50M storage fund.

FULL TOLL

Gridmatic pays a fixed monthly price to the owner and retains dispatch responsibility and market risk for the system with commitments for tolling agreements backed by our $50M storage fund.

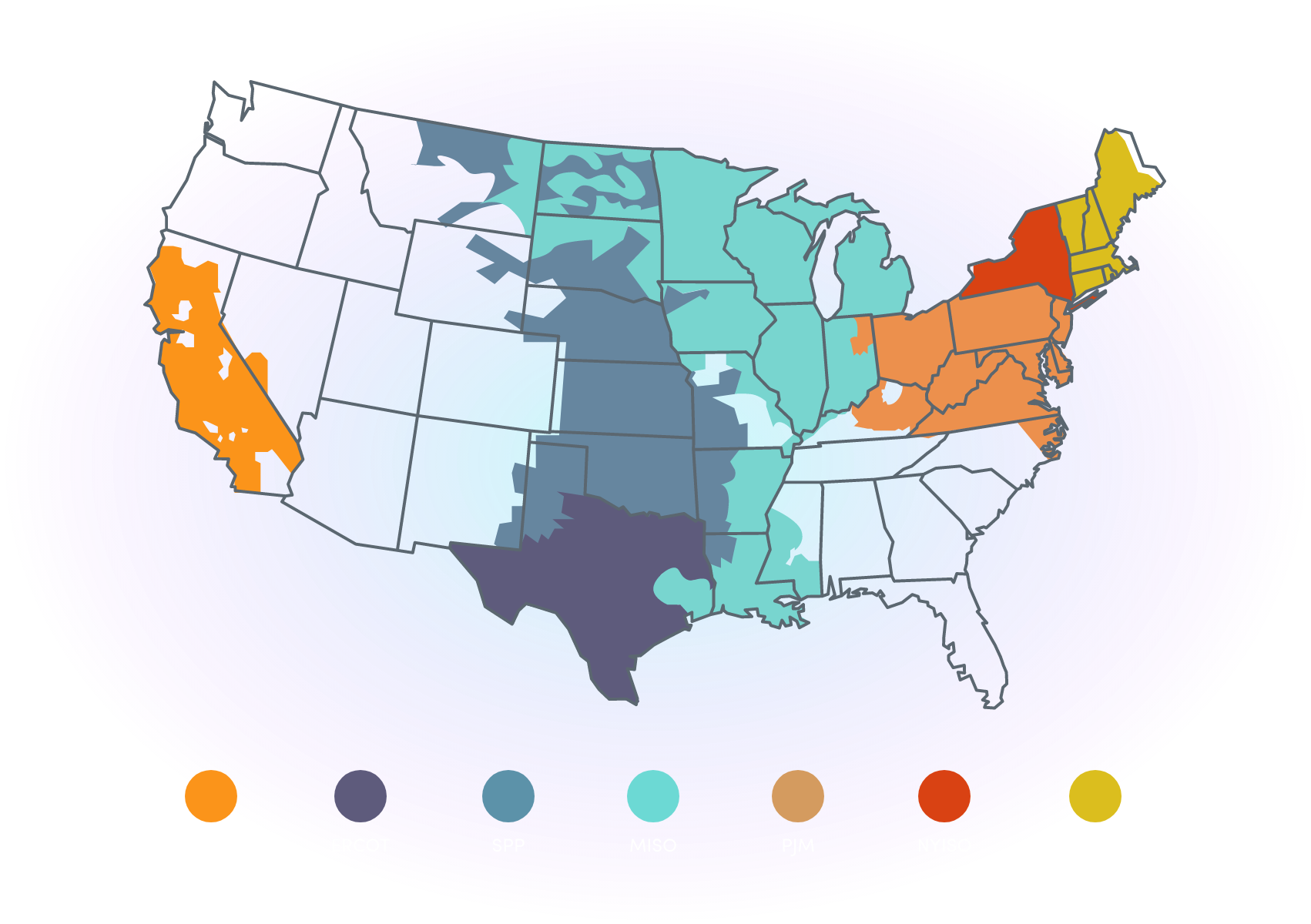

Cross-country coverage

Gridmatic is active across all 7 U.S. ISOs in terms of financial trading, energy retail supply for C&I customers, and/or storage optimization.

300 MW under contract across CAISO and ERCOT

Mark Tholke

Managing Principal, GSR Energy

The storage industry is growing rapidly and asset owners need every possible advantage to stay competitive. AI is the next frontier and the team at Gridmatic is comprised of world-class experts that are defining the crossroads of electricity markets and AI.

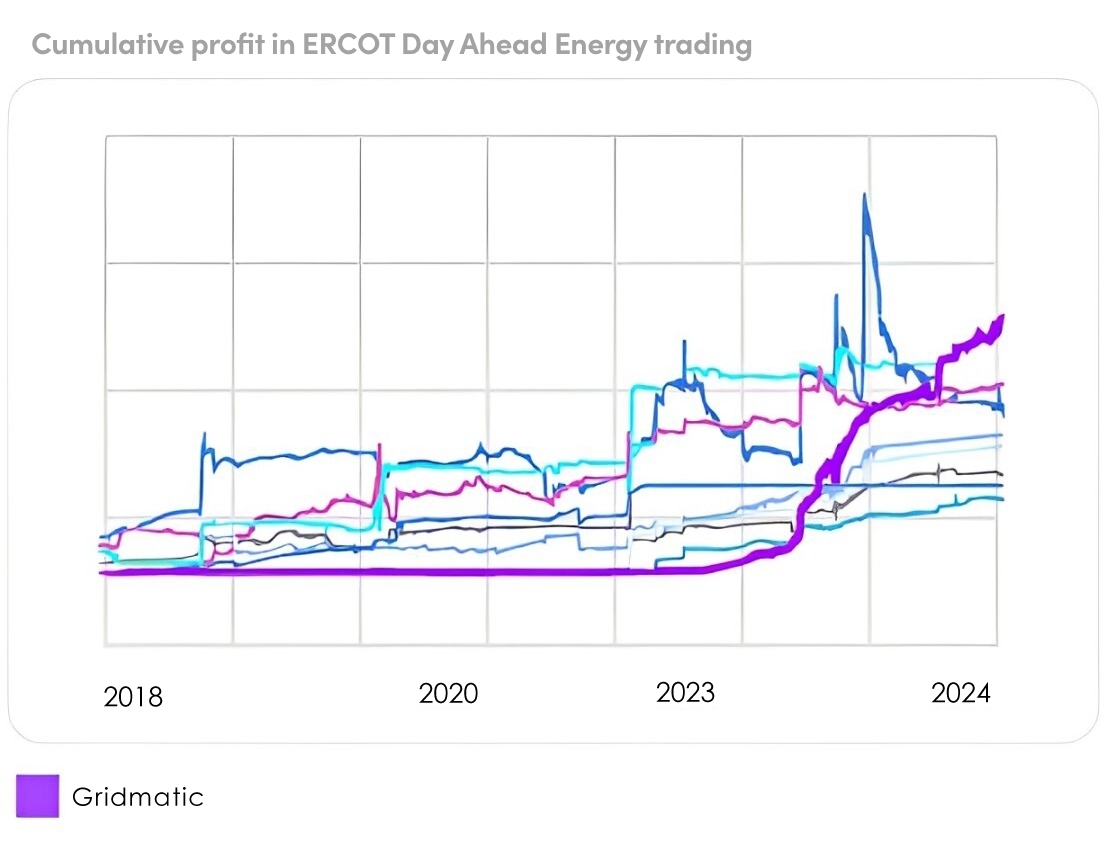

Day-ahead market forecasting

With revenues from ancillary services declining due to decreasing prices and saturation, Gridmatic’s excellence in short-term forecasting provides a distinct advantage as revenue profiles continue to shift amid increasing arbitrage opportunities.

Storage optimization: Powered by Gridmatic’s AI Leadership

To optimize revenues, forecast accuracy across day-ahead and real-time energy trading is paramount. Gridmatic demonstrates proven strength in forecasting excellence to deliver best-in-industry battery market participation.

32% potential increase in revenue using the Gridmatic battery scheduler

Read our ERCOT Storage Report for details

Download ReportLeveraging AI to optimize renewable energy trades for storage operators

Let us help you reduce risk and optimize your energy returns.