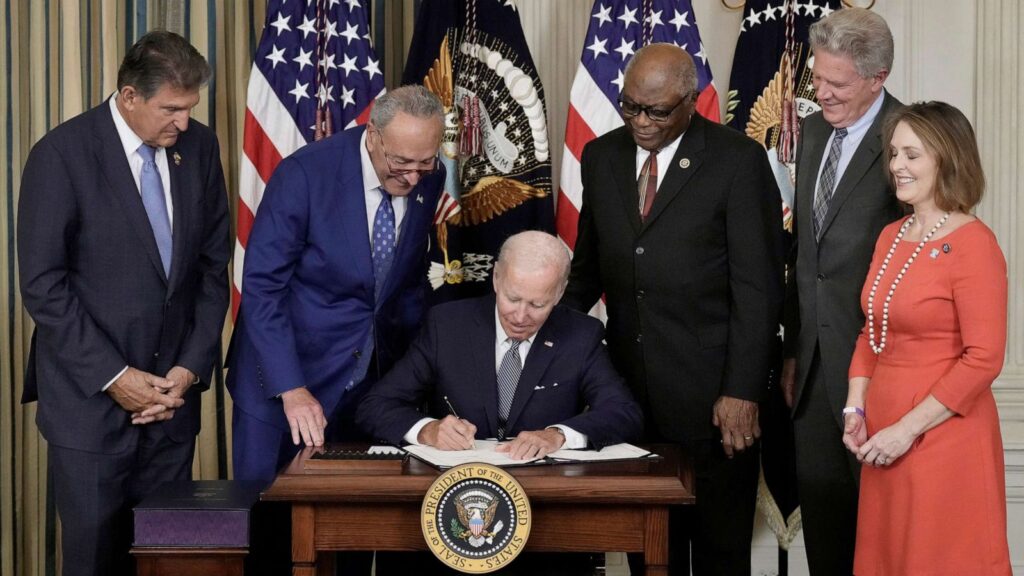

Inflation Reduction Act

The Inflation Reduction Act (IRA) is the most substantial climate-related legislation of our generation, with many far-reaching implications. Below are some changes and corresponding implications:

PTC solar eligibility

One of the biggest electricity market impacts will be eligibility of solar for the Production Tax Credit (PTC). Prior to the Inflation Reduction Act, wind and other renewable resources were eligible for PTC, but solar was only eligible for the Investment Tax Credit (ITC). Under the Inflation Reduction Act, the PTC offers a $26/MWh (and potentially higher) credit for all energy produced for 10 years, which is significantly more valuable to a utility-scale solar project than the one-time 30% ITC on CapEx. We expect most solar projects will elect the PTC rather than ITC going forward.

The key new requirement to get the base rate for both PTC and ITC is prevailing wage for construction, which will become common nationwide after this legislation. It was already standard in pro-labor states, such as California.

Daytime solar production

The impact of the solar PTC will be huge for daytime negative wholesale prices. Traditionally, ITC-eligible solar facilities have been much more willing to curtail output during negative price events compared to PTC-eligible wind facilities. The ITC drives prices to zero, whereas the PTC drives prices to the negative value of the PTC. That means big price changes are coming to high solar production hours. We would expect to see -$26/MWh prices (approximately), throughout the belly of the duck in the coming years.

Green hydrogen

Negative midday electricity prices could build a nice bridge for some of the earlier stage, energy-intensive industrial decarb solutions, like green hydrogen and molten oxide electrolysis for steel production. Midday negative prices do not reduce the need for a high capacity factor to amortize high CapEx, but they may substantially reduce the overall electricity cost for energy-intensive industries. More generally, the PTC will accelerate electrification, particularly for schedulable loads.

Figure 1: Estimated Hydrogen production costs before the PTC (Noussan et al, 2020).

Green hydrogen in particular is well positioned for rapid growth. The Inflation Reduction Act includes an up to $3/kg PTC for green hydrogen production. Taking Noussan et al’s 2020 cost estimates, the green hydrogen PTC is equivalent to an entire decade of tech improvements. The PTC is enough to immediately make green hydrogen competitive with fossil fuel-based production methods. The picture is likely even rosier for green hydrogen than Figure 1 demonstrates, since the recent spike in natural gas costs will add to the price tag of blue and grey hydrogen. This subsidy will materially impact green hydrogen production, which could catalyze a big US-based green hydrogen industry.