From Backup to Backbone

The role of storage on prices as illustrated by the Moss Landing outage

Author: Austin Park, Engineering Manager, Gridmatic

CAISO’s rapid storage rise kept ancillary service (AS) market prices in CAISO pegged near zero for several years, outside of heat waves. Then, on January 16, 2025, a fire broke out at the Moss Landing Energy Storage Facility in California. As a result, operations were suspended at all three phases of the site. With a nameplate capacity of 750 MW / 3,000 MWh, Moss Landing is one of the largest battery energy storage systems (BESS) in the world. Its scale is particularly notable — equivalent to roughly 0.5% of California’s daily energy use, and a significant share of the state’s fast-ramping ancillary services.

This incident offers a natural experiment: What happens to wholesale prices when a large chunk of fast-response capacity disappears overnight? In this post, we explore price data from before and after the Moss Landing outage to understand its impact on CAISO’s energy and AS markets.

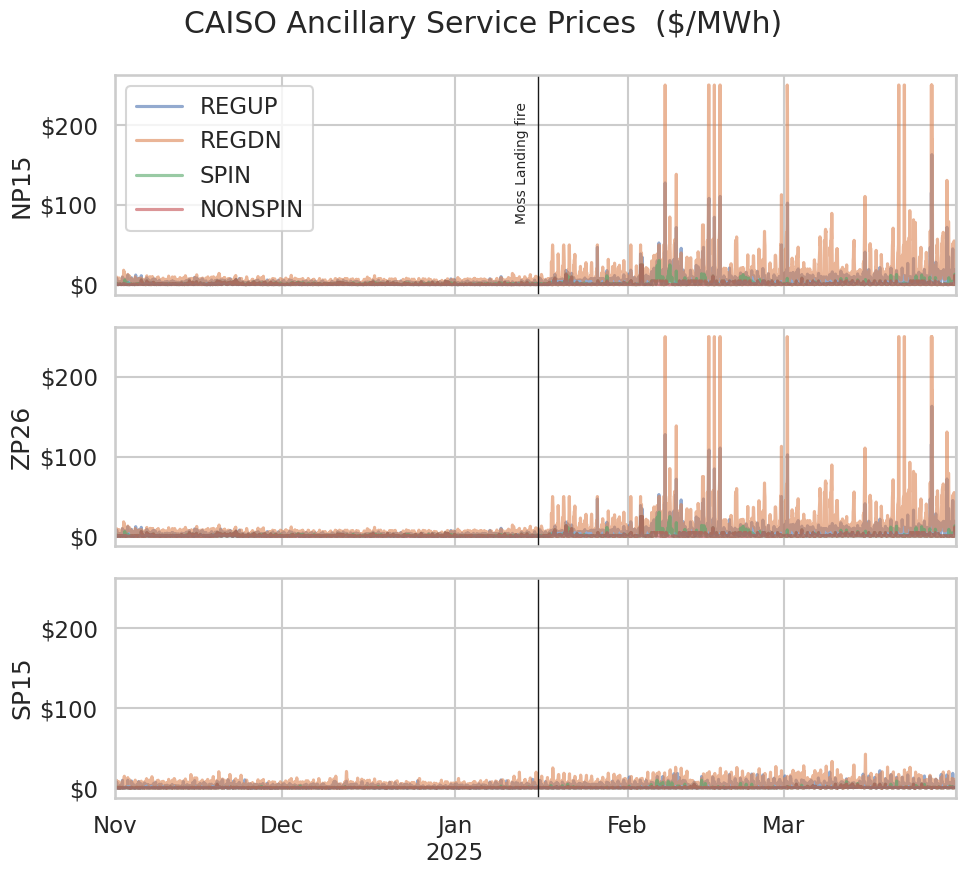

A dramatic change in Ancillary Service prices

The chart above compares ancillary service (AS) clearing prices from before and after January 16, 2025 across CAISO’s three primary load zones:

Following the Moss Landing fire and the BESS’s subsequent shutdown, we observe a notable increase in AS prices, especially for regulation and spinning reserve products. The effect is most pronounced in NP15 and ZP26, which are the zones most directly supported by Moss Landing’s fast-response capabilities.

Regional AS prices

Ancillary services are delivered on the same transmission lines as energy products. And just like energy, their delivery is constrained by line limits. But unlike nodal energy prices (LMPs), AS prices in CAISO are regional. CAISO divides the state into regions, and sets allowable procurement ranges, for each ancillary product.

With such thin AS markets, and over 13 GW of installed storage, regional procurement targets never mattered much. But the vast majority of storage sits in SP15. Add to that the fact that 750 MW suddenly vanished from NP15, and ancillary congestion emerges.

This story is more than a variation on the familiar North-South price divergence. It depends on resources outside of CAISO. AS can be supplied by out-of-state resources connected via interties. To ensure reliability, CAISO imposes higher minimum procurement requirements in the NP26EXP region—which includes NP15 and intertie-connected resources north of the Path 26 transmission line that connects the Central Coast to Southern California. It’s this constraint that began binding nearly every hour of the day.

In the graph above, the light blue shaded areas represent the allowable RegDn procurement range (minimum to maximum MW) set by CAISO for resources in NP26EXP, while the dark blue lines show actual procurement levels. On Jan 18, a visible shift occurs: actual procurement begins to track closely to the minimum allowable level. As the system reaches these procurement minimums, additional RegDn supply must be sourced at higher cost, leading to the observed AS clearing price increase.

Conclusion: Storage is critical for keeping prices low

Moss Landing offers a rare and instructive example of AS unsaturation: what happens when a major storage asset is suddenly removed from the grid. Despite accounting for less than 1% of California’s daily energy consumption, Moss Landing’s 3,000 MWh of fast-response capacity played a central role in keeping AS prices low.

As grids integrate more intermittent renewables and retire traditional thermal generation, storage will expand its price-moderating impact from regional AS constraints to energy prices across the ISO, acting as the balancing backbone of the system. Moss Landing’s outage reminds us that storage is not just a curiosity—it’s core market infrastructure.